Automated Excel Template for Payroll with PAYE Calculator, PENSION, PAYSLIP and Payment Schedule [2026 PAYE/TAX Update Inclusive]

47,638 2,474Category: Excel Templates, Business Software, Office, Business Utitilties, HRM, Health Care & Medicals

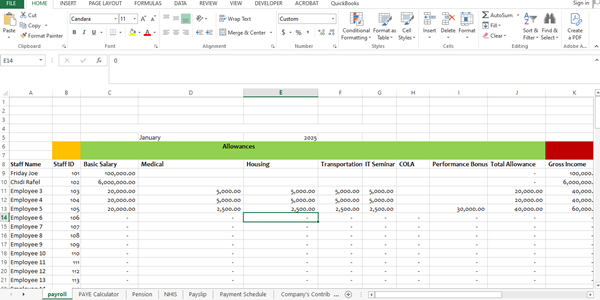

This is the Perfect Excel Template for Small and Emerging Businesses, government agencies, NGOs, private and public institutions in Nigeria for everything payroll and HRM. This template covers areas such as the Current Personal Income Taxation rates in Nigeria, Pension, NHF, Life Assurance and Tax Reliefs.

With a Friendly User Interface, Users can adopt the template easily into their business operation. This template was designed by professional accountants and specially built for increased productivity in the HRM process of any organization.

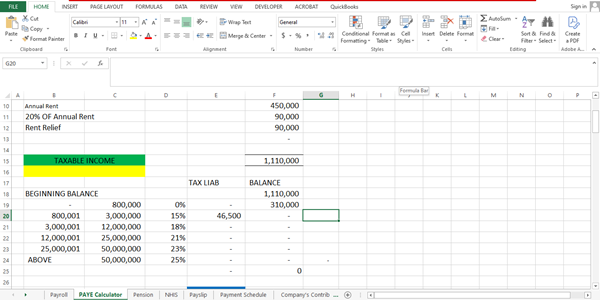

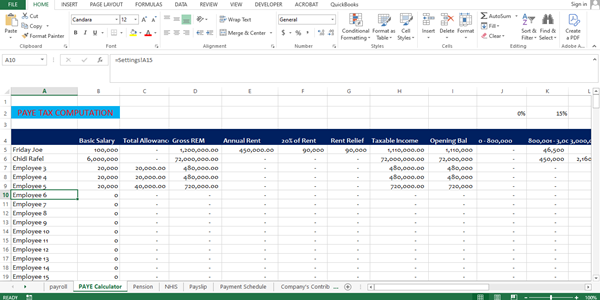

The Payroll Captures the Latest Tax Bands and Reliefs effective from January 2026. The New Rent Relief is Lower of 20% of Annual Rent or N 500,000. Below is the breakdown of the new Tax bands/Brackets:

Tax Band (NGN)%

| 0 - 800,000 | 0% |

| 800,001 – 3,000,000 | 15% |

| 3,000,001 – 12,000,000 | 18% |

| 12,000,001 – 25,000,000 | 21% |

| 25,000,001 – 50,000,000 | 23% |

| Above 50,000,000 | 25% |

FEATURES:

1. Sleek and User friendly/Easy-to-use Interface.

2. Accurate Personal Income Taxation (PIT) using the Current Nigerian Tax brackets and the Finance Act 2025.

3. Pension, NHIS, NHF, Loans and other Consolidated Tax Reliefs.

4. Admin Settings for easy customization and management of employees and the company.

5. Life Assurance.

6. Monthly Staff Payroll Sheet.

7. Automated and printable Employee Pay Slip Page.

8. Can take up to 500 employees and even more via simple copy and paste of formula.

9. On the go and ready automated Payroll prepared.

10. Employer's contribution for pension, NHIS, NHF, ITF, NSITF automated for you.

This Template runs on all Windows and MAC operating systems with Excel 2007 or later versions installed.

Version 6.0 (2026)

![VAT and Company Income Tax Excel Template [2025 Updated]](https://softwarehub.ng/images/0454bf5597ea67378394c2af5f6cf792.png)

![Comprehensive Sales and Inventory Management Excel Template [xlsm]](https://softwarehub.ng/images/0bf50ab903b4194d2fa9e92b656c3caf.jpg)