VAT and Company Income Tax Excel Template [2025 Updated]

6,998 215Category: Accounting, Business Utitilties, Excel Templates

Overview

Value Added Tax (VAT) is a type of tax charged on Sales or Revenue made by an organization. It is indirect taxation mechanism adopted by the government to generate revenue via sales made by businesses.

Value Added Tax (VAT) or Sales Tax is currently 7.5% in Nigeria and the government expects businesses eligible to pay VAT to remit 7.5% of sales made from the 21st of every month. VAT is it is commonly called is mostly paid to the Federal Inland Revenue Service (FIRS) by corporate bodies montly

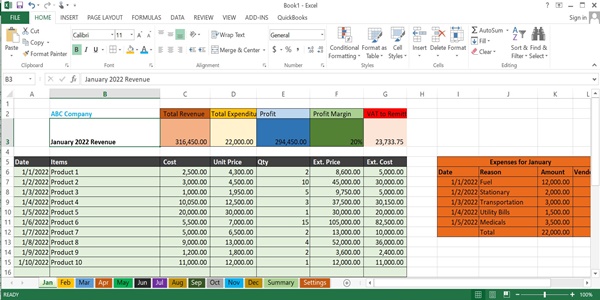

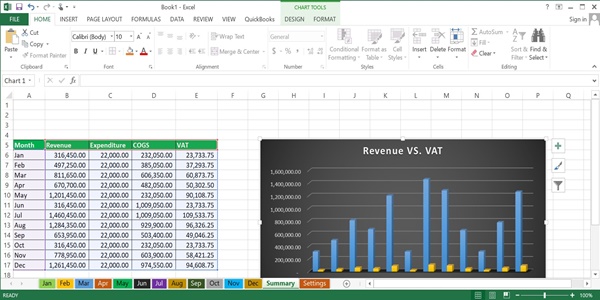

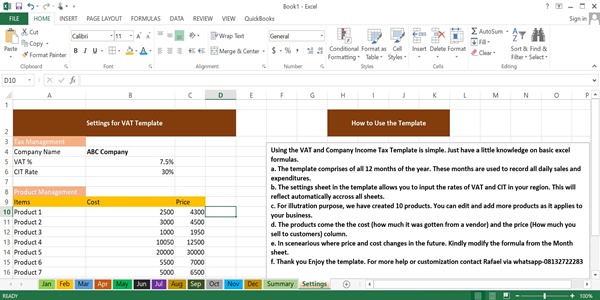

This Excel Template will save you the stress of calculating montly VAT remittances and Annual Corporate Income Tax (CIT). The VAT excel template captures Daily sales, Tracks expenditures and computes accurate amounts to be remitted monthly to the Federal Inland Revenue Service or any other tax body in Nigeria.

Small and emerging businesses will find this utility template useful for easy Value Added Tax (VAT) and Company Income Tax (CIT) computation.

The template will save you great cost, money and time as all features are programmed to be responsive to your feedback.

Features

- Easy and User friendly interface.

- Current Tax rates and methodology in accordance to the FIRS Finance Act 2020 as amended.

- Monthly VAT Calculator. Annual CIT Computation.

- Easy Expense and Cost of Sales Tracking.

- Manual on How to Use Template.

- Input Model for Easy Customization.

MS Excel Template

MS Excel Template

![Automated Excel Template for Payroll with PAYE Calculator, PENSION, PAYSLIP and Payment Schedule [2026 PAYE/TAX Update Inclusive]](https://softwarehub.ng/images/fbe067e9d6194f3e199f328b42753e0c.png)