Online Banking & Loan Management PHP Script with Payment Gateway

3,188 89Category: PHP SCRIPTS, Office, Accounting

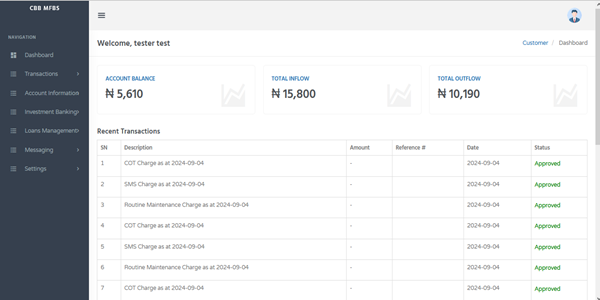

This online banking and loan management PHP script is a fully-featured solution designed for businesses looking to offer seamless financial services. The script integrates critical banking functions like deposits, transfers, withdrawals, loan requests, and investment banking, along with advanced features that elevate its utility for both administrators and users.

Key Features:

-

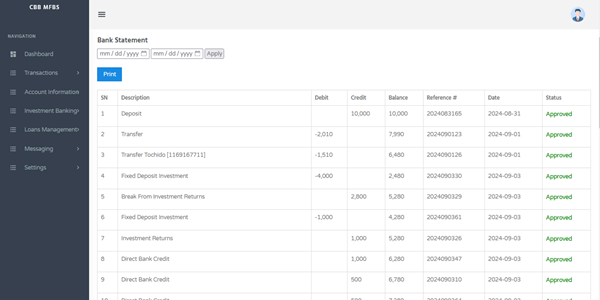

Deposits, Transfers, and Withdrawals: These core functionalities are optimized for simplicity and security. Users can deposit funds, transfer between accounts, and request withdrawals with ease, supported by seamless integration with payment gateways for smooth transactions. Users can also do top ups to the wallets via payment gateway such as Paystack.

-

OTP Validations & Email Notifications: To ensure security, the script comes equipped with One-Time Password (OTP) validations for sensitive transactions, adding a layer of protection. Coupled with email notifications, users receive instant alerts for every transaction, login attempt, or important updates, keeping them informed at all times.

-

Bank Charges: Bank charges are automatically applied for transactions such as withdrawals and transfers. This feature allows businesses to set up dynamic charges, making fee management transparent for both customers and admins.

-

Loan Request & Default Penalties: The loan request feature makes the process of applying for and managing loans straightforward. For businesses offering credit, the inclusion of loan default penalties ensures that overdue payments are handled systematically, with fees applied based on predefined rules.

-

Penalties for Fixed Deposit Breakout: In case of premature withdrawal of fixed deposits, users are subjected to penalty fees, ensuring compliance with the terms of their fixed deposit agreements. This helps institutions maintain financial stability and encourage users to adhere to contract terms.

-

Customer Management System: This feature streamlines customer interaction, allowing admins to manage user accounts, view transaction histories, handle loan applications, and offer customer support, all within an intuitive dashboard.

-

Printable Bank Statements: Users can generate and print bank statements directly from the platform, offering a detailed view of all account transactions, withdrawals, deposits, and charges. This enhances transparency and provides users with a professional banking experience.

-

Investment Banking: Users can explore various investment opportunities through the platform, enabling them to grow their savings while tracking returns and investment options easily.

-

Web Mails: The web mail feature allows direct communication within the platform, fostering real-time, secure correspondence between users and the financial institution. This is especially useful for addressing customer inquiries or sending out important banking notices.

Performance and Usability:

The script performs exceptionally well, handling a high volume of transactions without lag or errors. Both the front-end and back-end are designed with usability in mind. The interface is intuitive, responsive across devices, and offers easy navigation for both tech-savvy users and novices.

Security:

With OTP validations, secure email notifications, and a focus on encrypted transactions, the script offers advanced security protocols, ensuring user data is protected at all times.

Use Cases

This Online Banking and Loan Management PHP Script is suitable for:

1. Small and Emerging Micro-Finance Banks Looking for a simple but efficient online banking software to kick start their operations.

2. Co-operative and Thrift Societies that help members manage savings and issue out loans.

3. Organizations that generally manage transfer of funds, withdrawals and enable savings for members or employees.

4. Student researchers who wish to work on an online banking software for academic purpose.

Runs on PHP 5.6 and Above

V.1 (2024)