Most Fixed assets when acquired have a life span and a salvage value (scrap value) at disposal stage.

Depreciation is simply how the wear and tear process of an asset. Over time, an asset loses value due to usage and obsolesce. Taking account of the wear and tear process of a fixed asset is vital for an organization to understand the useful life of an asset and plan for replacement once the asset finally gets out of use.

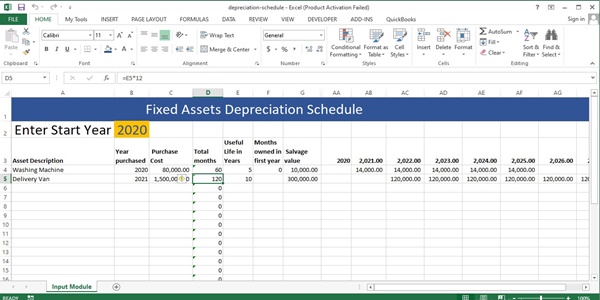

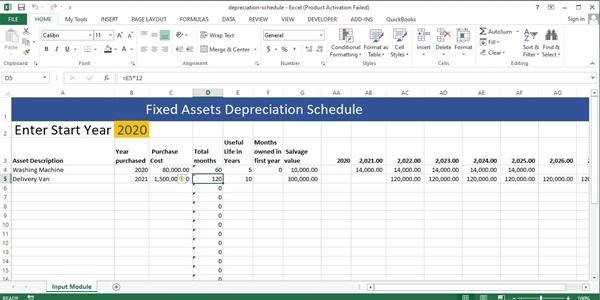

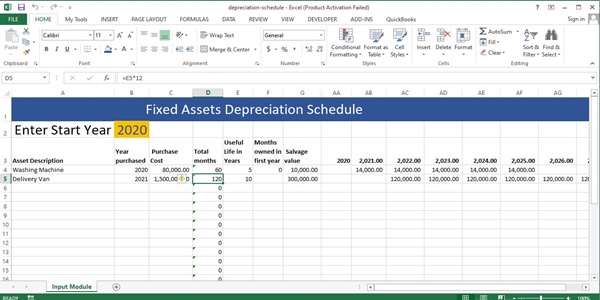

The template use the straight line method of depreciation to calculate depreciation on assets. This method is commonest among businesses and easier to input.

The template helps organize all fixed assets and calculate their depreciation yearly.

Features of the Template

- Fully Automated Imputation Interface

- Input Mode with Macros for recording day-to-day Fixed Asset acquisition and depreciation.

- Minimum or no manual imputation necessary for accurate reports.

- 24/7 Support from our vast community of developers.

- Easy to set-up and super user friendly.

Use Scenario

- Small and Medium Scale businesses that need a depreciation template to manage their fixed assets and track depreciation with ease.

- Accountants and Auditors.

- Tax officials.

- Software developers who want to integrate depreciation features to their applications.

- Individuals and Corporate bodies that need an affordable option to a fully developed accounting Software such as QuickBooks and Sage50

Ms Excel Template

V.1 (2022)

![Advanced Trial Balance Excel Template [XLM]](https://softwarehub.ng/images/4749ca1549cdee174d897681e4315960.png)

![Automated Excel Template for Payroll with PAYE Calculator, PENSION, PAYSLIP and Payment Schedule [2026 PAYE/TAX Update Inclusive]](https://softwarehub.ng/images/fbe067e9d6194f3e199f328b42753e0c.png)