Point of Sale(POS) Financial Business Plan and Projections

9,813 425Category: Financial Plans & Projections

Overview of POS Business in Nigeria

The POS business also referred to as Mobile Banking or Agency Bank Business, began in the year 2013. This came after the CBN launched particular guidelines on the management and operations of the business. Instantly hereafter, POS has been among the retail channel a number of financial institutions use as a tool to make their banking services available to a lot people.

If you are aiming to begin the POS business, get a POS machine for your business, it is therefore suggested to think about locations that are unbanked or underbanked. By doing this you are most likely to have an enormous influx of clients.

Before you can begin the POS business, it is essential that you are first accredited as an agent. As an agent, you will own and run a retail outlet. In this outlet you can perform financial transactions such as withdrawal, deposit, transfer, airtime recharge, utility recharge, among many others.POS business is a thriving business in Nigeria at the moment. If you have actually been to banks and stayed for hours all for performing transaction, after that you will understand that POS is a really positive strategy. Asides from providing conveniences to people, it has additionally provided jobs for lots of young business owners in Nigeria.

Potentials of POS Business in Nigeria

POS or agency banking services are becoming Nigeria's pillar of financial transactions. The reasons the business is profitable for countless Nigerians are that; the insufficient number of functional ATMs which brings about long queues. Bad network service at ATM points and banking halls has pushed lots of customers to discover alternative means of carrying out their transactions, and for the business operators, the low barrier entry demands in beginning POS business offer the much-needed job opportunity amidst high unemployment rates. Apart from this, it also assists customers easily withdraw money when the nearest ATMs are far away.

How to Startup a POS Business in Nigeria

The following criteria must be fulfilled in order to start a POS business in Nigeria: Have an Existing Business

- The POS business pertains to money. Consequently, the CBN is really specific regarding people that qualify to be an agent. For that reason, commercial banks take extra care before they can authorise anybody as an agent. To be qualified for a POS machine or to be an agent, you need to have an existing business. This business should have been in existence for a minimum of 12 months. Asides from this, you need to have a store or place of business. Additionally, you need to have your business name registered with the Corporate Affairs Commission.

- Approach the Bank of Your Choice The next thing is, choosing your financial institution of choice. After you have done this, you can approach the bank to understand their requirements. Nearly all banks in Nigeria accept agency banking services. As a matter of fact, you can be an agent for several banks as you can serve. You will be given forms to fill. This form is an agreement between you and the financial institution. It includes the terms and conditions of your application. Asides from this, they will ask for your: valid means of identification. This can be your National Identification Number, Utility Bills, Bank Verification Number, 2 passport photographs, 2 current account referees, Proof of your business registration, A minimum working capital of N50,000, and Tax Identification Number.

- Obtain the Necessary Tools As soon as the bank takes into consideration your application, the next action is to supply you with the tools and the equipment you need for the business. This will just be possible if your application succeeds.

- Get a Busy Location After you must have got the POS and other important devices you require from the bank, the next thing is to choose the location of your business. It is recommended that you take into consideration locations where there are limited banks and less ATMs. Asides from this, you can think about Bus Stops, event centers, and so on. If you pick an amazing location, your business will certainly flourish.

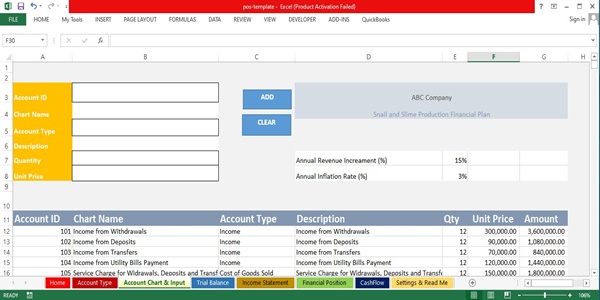

Overview of The Template

The Template gives concrete financial plan and projections for setting up a Point of Sale shop. Real business insights are included in this financial template to attract investors, grants and loans to make the business concern a reality.

The excel template is easy to use and modify. Current Real life prices were used in drafting this template by our team of seasoned accountants and financial analysts. The template is suitable for small and emerging businesses who see themselves giants in the various industries in 5 years time.

Features

- Comprehensive Income Statement (Trading, Profit & Loss Account)

- Statement of Financial Position (Balance Sheet)

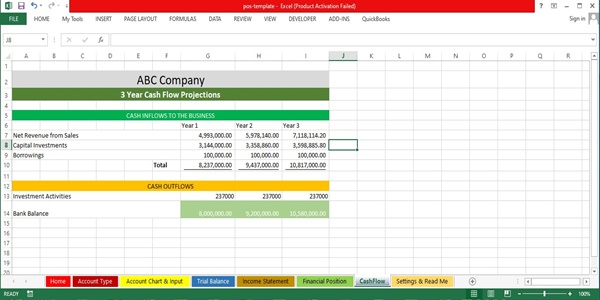

- Cashflow Statements

Use Scenarios

This excel template is most suitable for the following:

- Promoters of existing and New Start-up Businesses that need funding in form of grants,loans,partnerships etc. from governement agencies and venture capitalists.

- Business and Financial Analysts working on viability and feasibility of a Point of Sale business in Nigeria.

- Business Administration and Entrepreneurship students who need a comprehensive financial plan for a Business Plan.

- Investors and Venture Capitalist who need financial analysis of the Point of Sale business for informed decision making.

- Entrepreneurs who need expansion ideas for their businesses.

Ms Excel Template

V.1 (2022)

![DESIGN AND IMPLEMENTATION OF AN ONLINE REAL-TIME PARCEL TRACKING AND MONITORING SYSTEM (A CASE STUDY OF NIGERIAN POSTAL SERVICE [NIPOST])](https://softwarehub.ng/images/folder.png)